Predictions for the Digital Economy in 2026 Report is Live!

Mobile App Insights · Jess Li · June 2021

Three Key Takeaways from Sensor Tower's 2021 State of Marketplace Apps Report

Sensor Tower's new report on the state of marketplace apps reveals that the category continues growing in 2021.

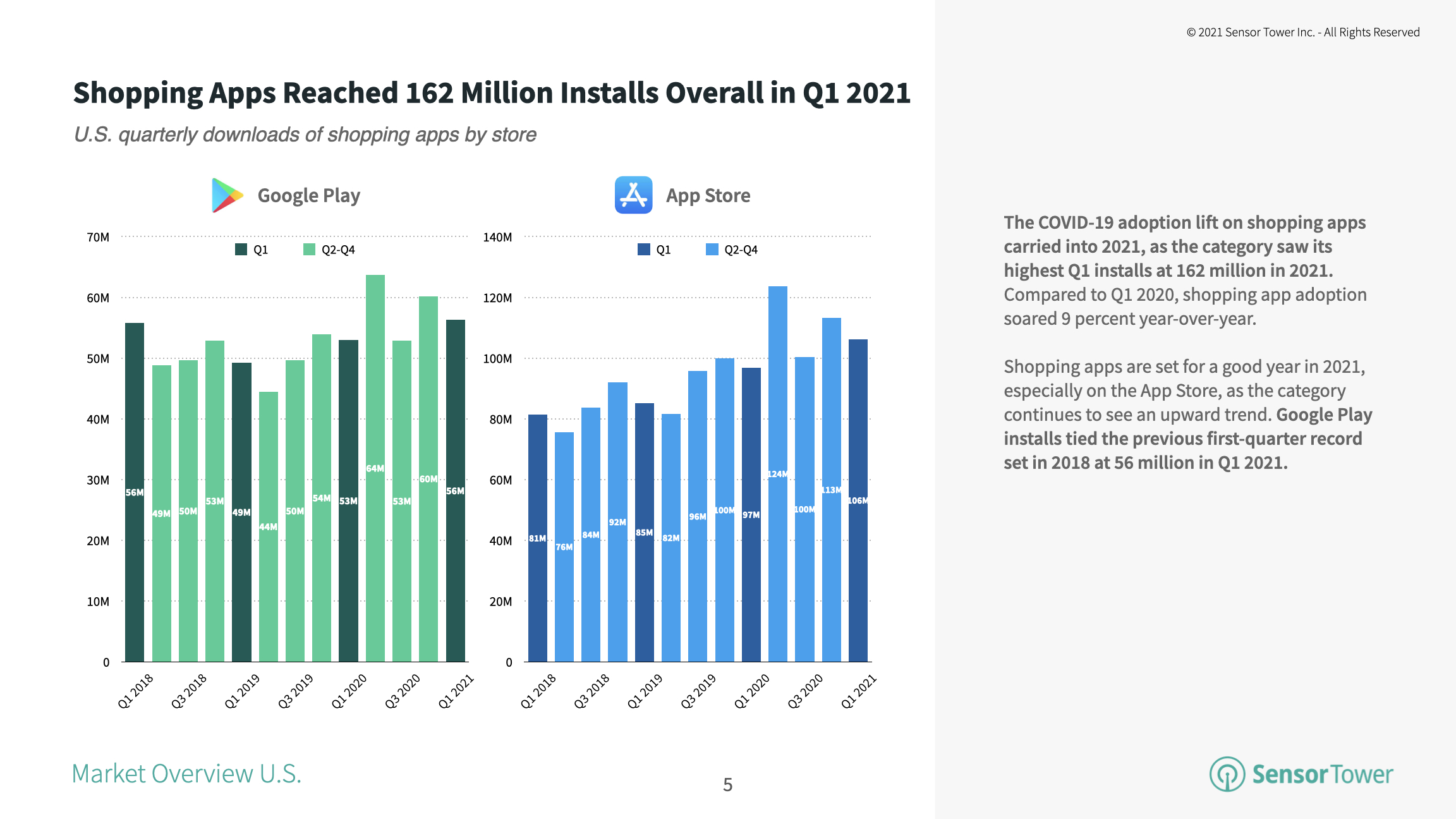

Shopping app installs saw explosive growth in the United States in 2020, climbing 19 percent year-over-year to 663.8 million and outpacing the previous year's growth by 15 percentage points. Sensor Tower's State of Marketplace Apps 2021 report, available now, is a deep dive into consumer-to-consumer (C2C) marketplace apps, analyzing how this subcategory of retail apps was impacted by the COVID-19 pandemic and examining its latest trends in early 2021.

The Top Marketplace Apps Maintained 33 Percent Market Share in Q1 2021

Shopping apps have seen a persistent lift in overall adoption since last year, when consumers turned to mobile shopping in vastly increased numbers. In 2021, the category saw its highest-ever first quarter installs with 162 million from across U.S. app stores. Within the category, marketplace apps such as Amazon and Wish accounted for a 33 percent share of downloads among its top 100 apps.

While marketplace apps command a strong presence in the shopping category, their market share has been shrinking over the past three years, falling from 40 percent in 2018. This might be due in part to the proliferation of brick-and-mortar stores launching single-brand retail apps, a trend which accelerated last year during the COVID-19 pandemic.

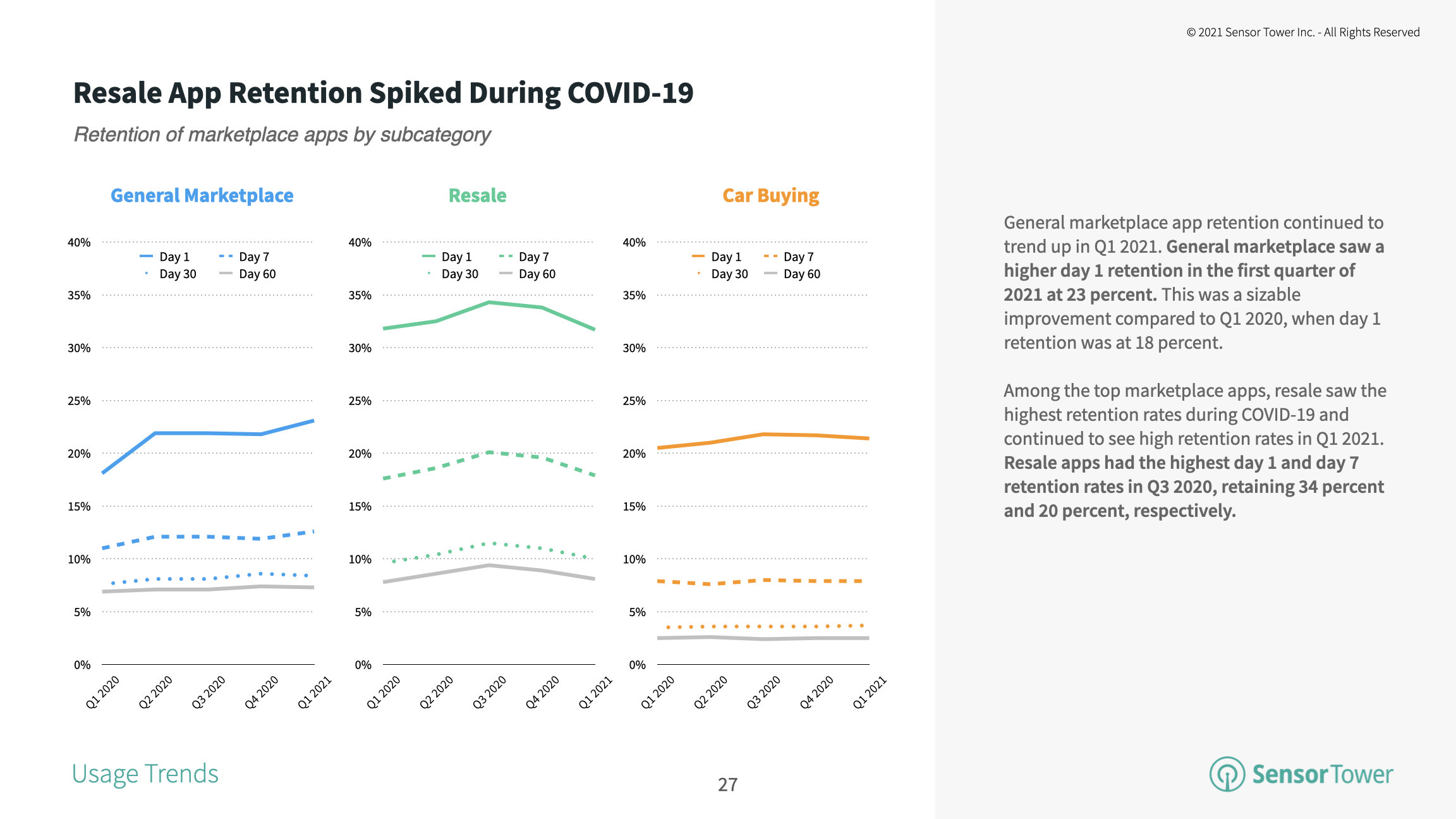

Resale App Retention Continues to Climb in 2021

Across the three types of marketplace apps we looked at—general, resale, and car buying—user retention trended upward in 1Q21. However, among the top six apps, resale platforms such as OfferUp and Poshmark led the pack with the highest retention rates throughout 2020 and continuing into the early part of this year.

Although resale app retention is higher, general marketplace apps saw the most growth year-over-year. In 1Q21, the top general marketplace apps saw a day 1 retention rate of 23 percent, 5 points higher than 18 percent in 1Q20.

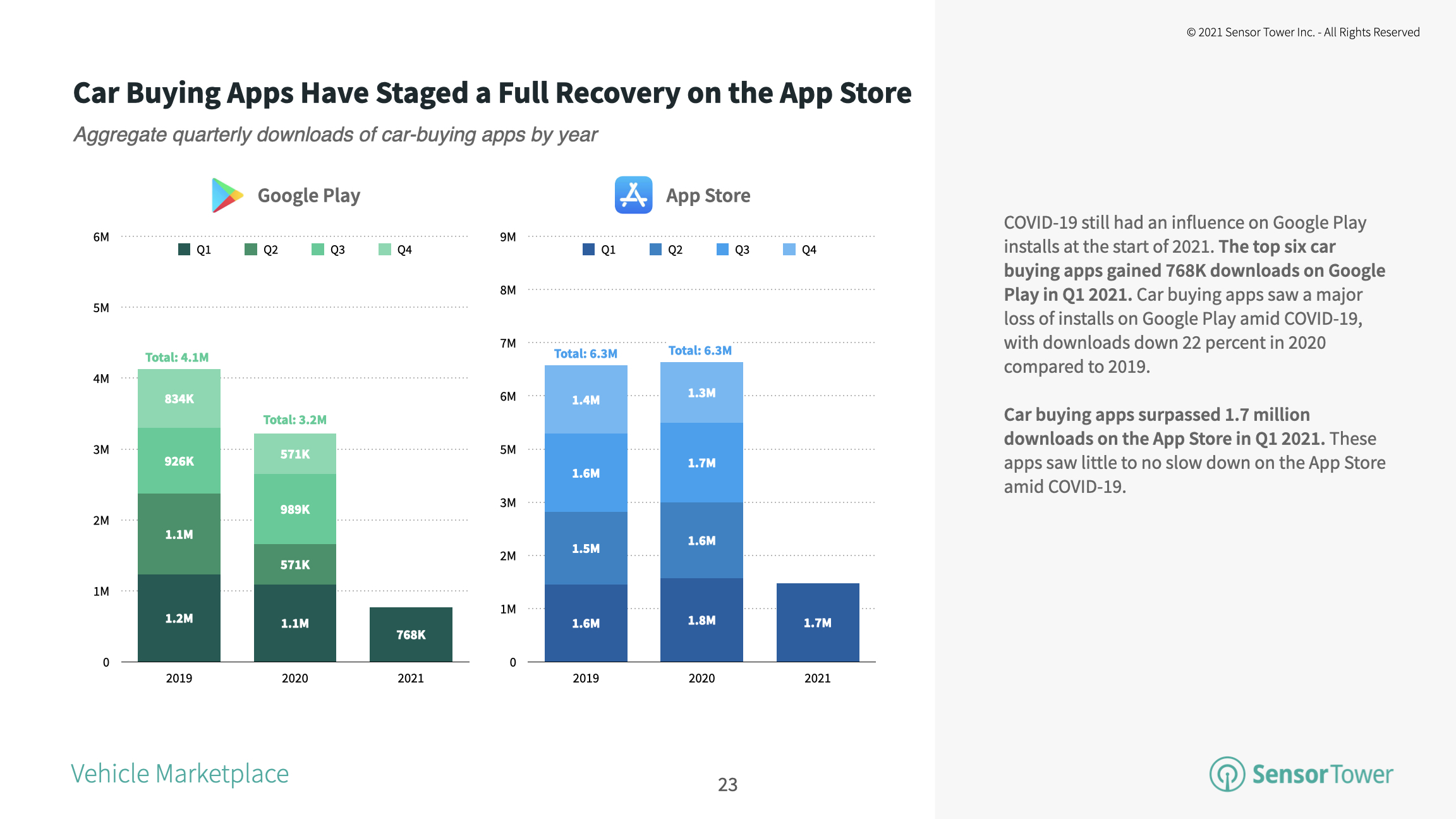

Car Buying Apps See Consistent Installs on the App Store

Car buying apps in the U.S. saw a full recovery in 1Q21 when compared to 1Q19. Across both the App Store and Google Play, the top six apps of this type collectively reached approximately 2.4 million installs. This was led by iOS users, which accounted for double the installs of Android users.

While App Store installs of these types of apps have remained fairly consistent over the last two years, Google's marketplace has seen declining downloads. In 2020, car-buying apps reached about 3.2 million installs, down 22 percent Y/Y from a little more than 4 million the previous year.

For more analysis from the Sensor Tower Store Intelligence platform, including key insights on the performance of top marketplace apps in the U.S., download the complete report in PDF form below: