Predictions for the Digital Economy in 2026 Report is Live!

Gaming Insights · Yuwen Huang · March 2023

The Latest Trends Shaping The Mobile Gaming Ecosystem

Mobile gaming downloads and revenue are trending lower, but some types of games are more affected than others. Here's why.

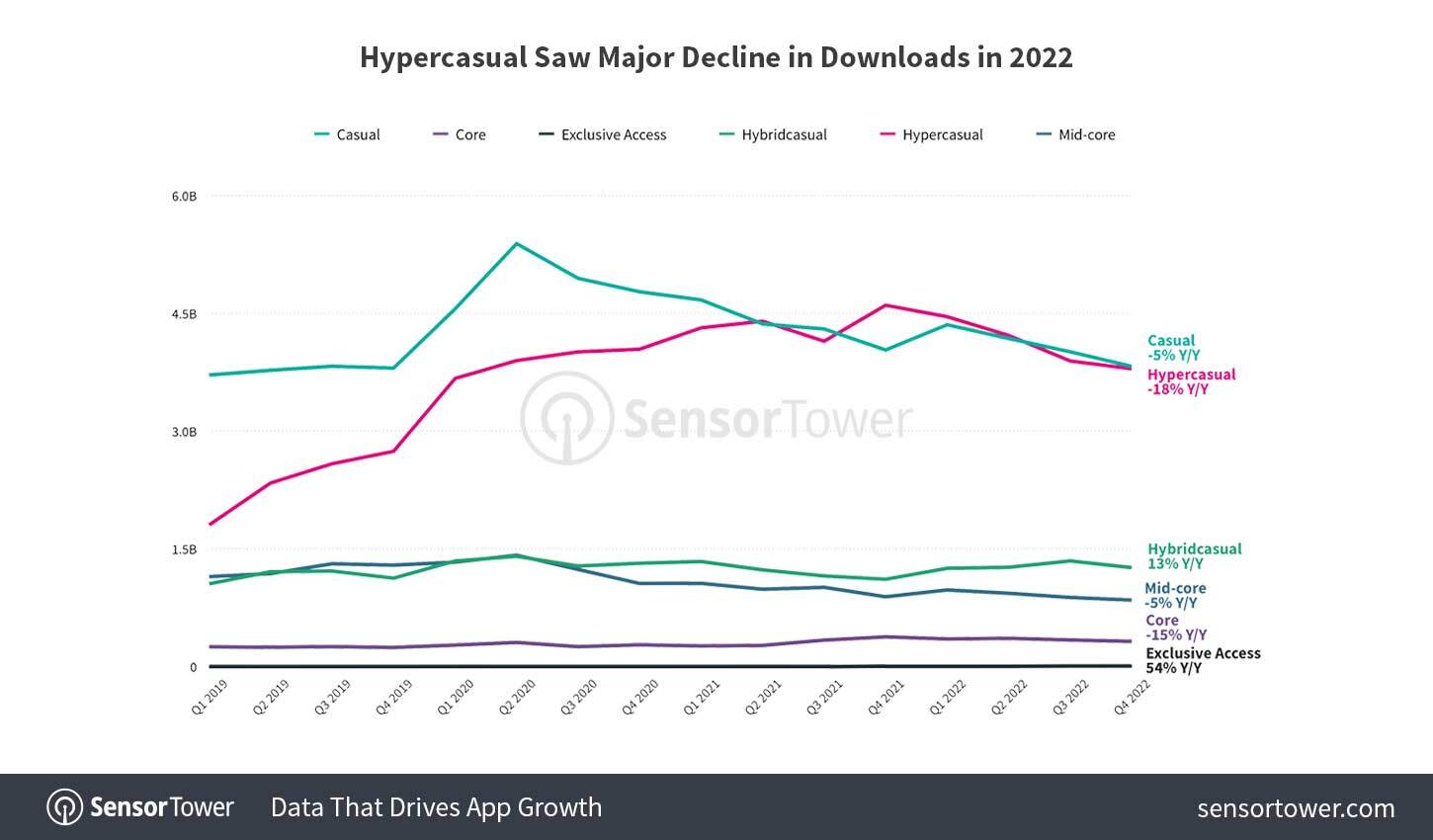

Mobile game downloads are affected by multiple factors today, including ATT policies that impact cost per install, the economic recession affecting user acquisition budgets and the overall post-covid macroeconomic recovery. The most impacted games in recent years are in the Hypercasual, Shooter, and RPG genres, according to our State of Mobile Gaming report. At the same time, emerging game patterns and product models like Hybridcasual and External Game Subscriptions like Netflix are finding success. Why is this?

Mixed Outcomes

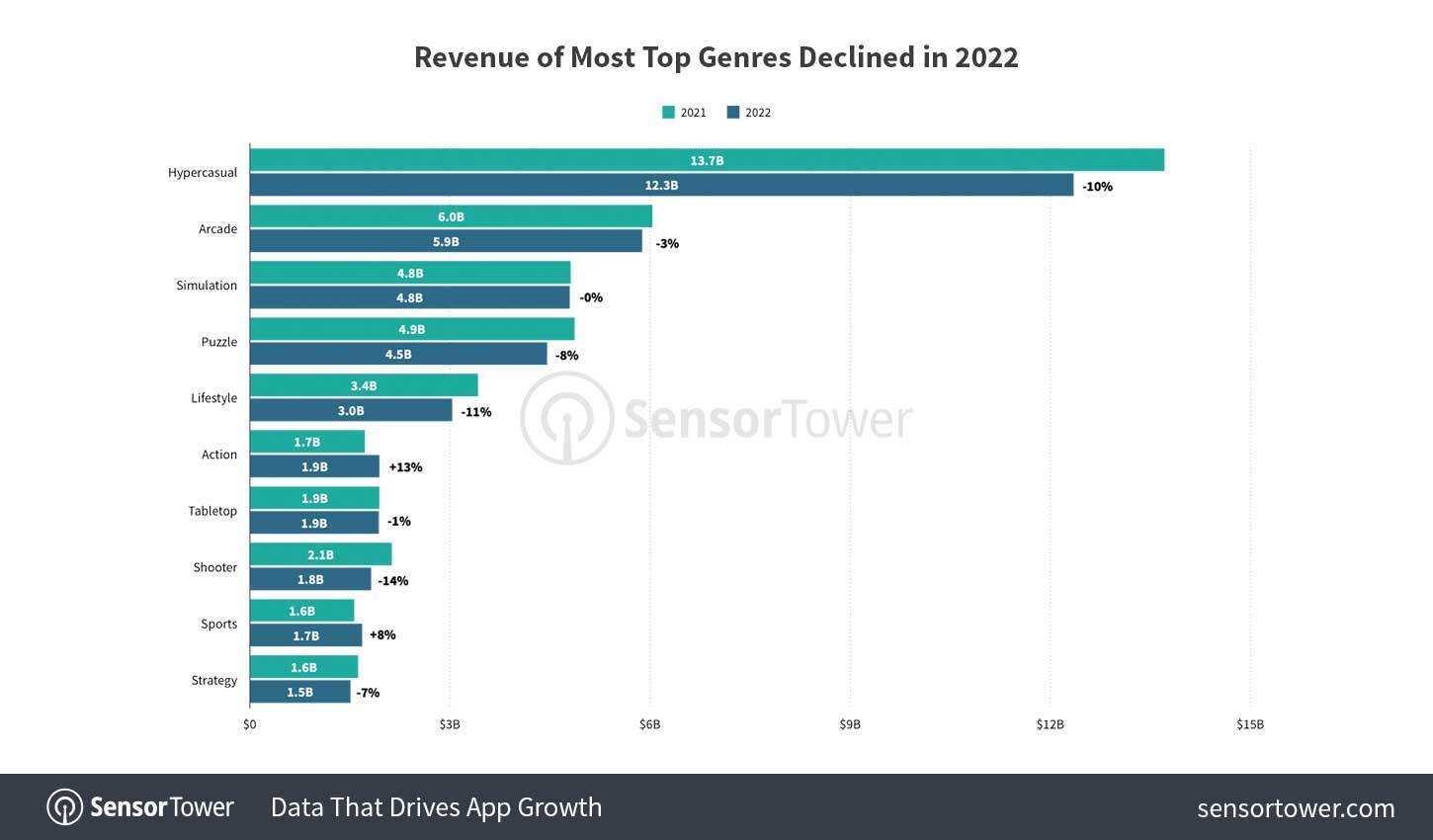

The top five genres by downloads in 2022 were the same as in 2021. Hypercasual remained on top in spite of a decrease of 10 percent in 2022 overall, a drop of 24 percent in Q4 2022, and a continued trend downwards in 2023.

In 2022, Simulation surpassed Puzzle as the No.3 Genre by downloads, fueled by Roblox and a new trend in Simulators, Sandbox and Tycoon/Crafting games utilizing a Hybridcasual product model.

While each of the top 5 genres exhibited negative growth in 2022, Action games registered double-digit growth at 13 percent in downloads, mainly due to the strong performance of Shoot’em Ups like Survivor.io and Action Sandbox games like School Party Craft which inherits game patterns from Roblox.

Hybridcasual Product Model Saw 14 percent Increase in Downloads in 2022

The Hybridcasual Product model combines multiple elements from classic business strategies into one:

Easy to understand main mechanics that require low cognitive effort like Hypercasual games.

Simplified long term Meta-Features like Character Collections and Progression, inherited from Mid-Core games.

Hybrid monetization strategies, featuring currency bundles and progression packs from Casual games, and interstitials and rewarded ads with implementations similar to hypercasual games.

Often, lower production costs than casual games, and thus the use of more generic assets, codebase and logic from other projects, in a Hypercasual fashion.

A broad appeal to multiple audiences due to its unique combination of Mid-Core, Hypercasual and Casual personas.

For more insights on the latest Trends in Mobile gaming, download the full State of Mobile Gaming 2023 report below: