Predictions for the Digital Economy in 2026 Report is Live!

Mobile App Insights · Digital Advertising Insights · Marco Scacchi · December 2022

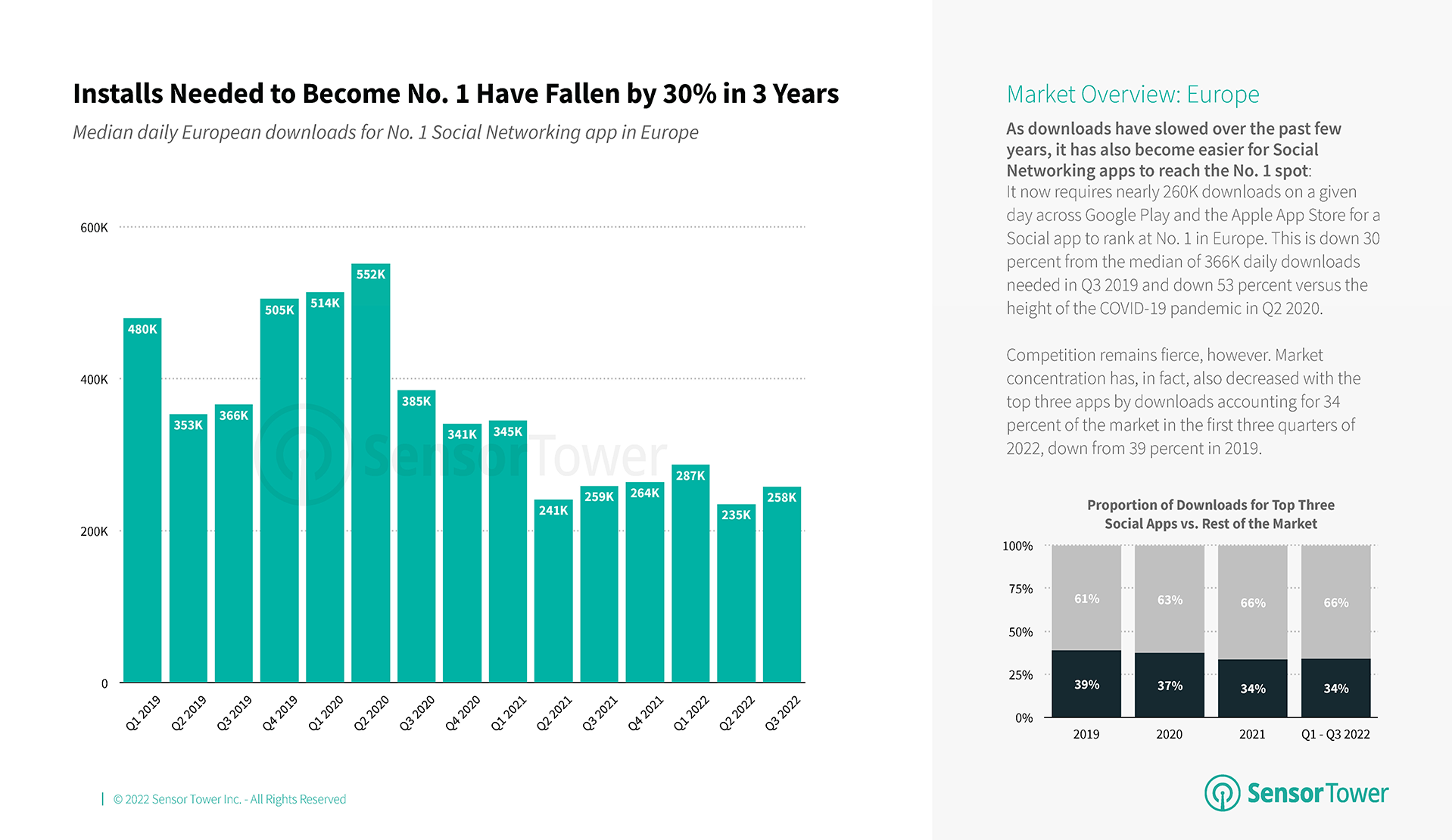

Social Apps Need 260,000 Downloads to Rank at No. 1 in Europe, Down 30% from 2019

Our latest report also reveals this is down 53 percent compared to the height of the COVID-19 pandemic in Q2 2020 when the No. 1 app averaged 552,000 installs.

While social networking app adoption has slowed compared to 2019 and 2020, Sensor Tower data shows a number of emerging trends across the category are boosting engagement. Sensor Tower’s State of Social Apps in Europe report, available now, also reveals that the number of downloads needed to rank at No. 1 in Europe has decreased by 30 percent compared to Q3 2019. In Q3 2022, a Social app needed 260,000 installs on a given day across the App Store and Google Play, down from 366,000 in 3Q19. The decrease is even more marked (down 53 percent) when compared to the height of the pandemic in Q2 2020 when Social apps needed an average of 552,000 daily installs.

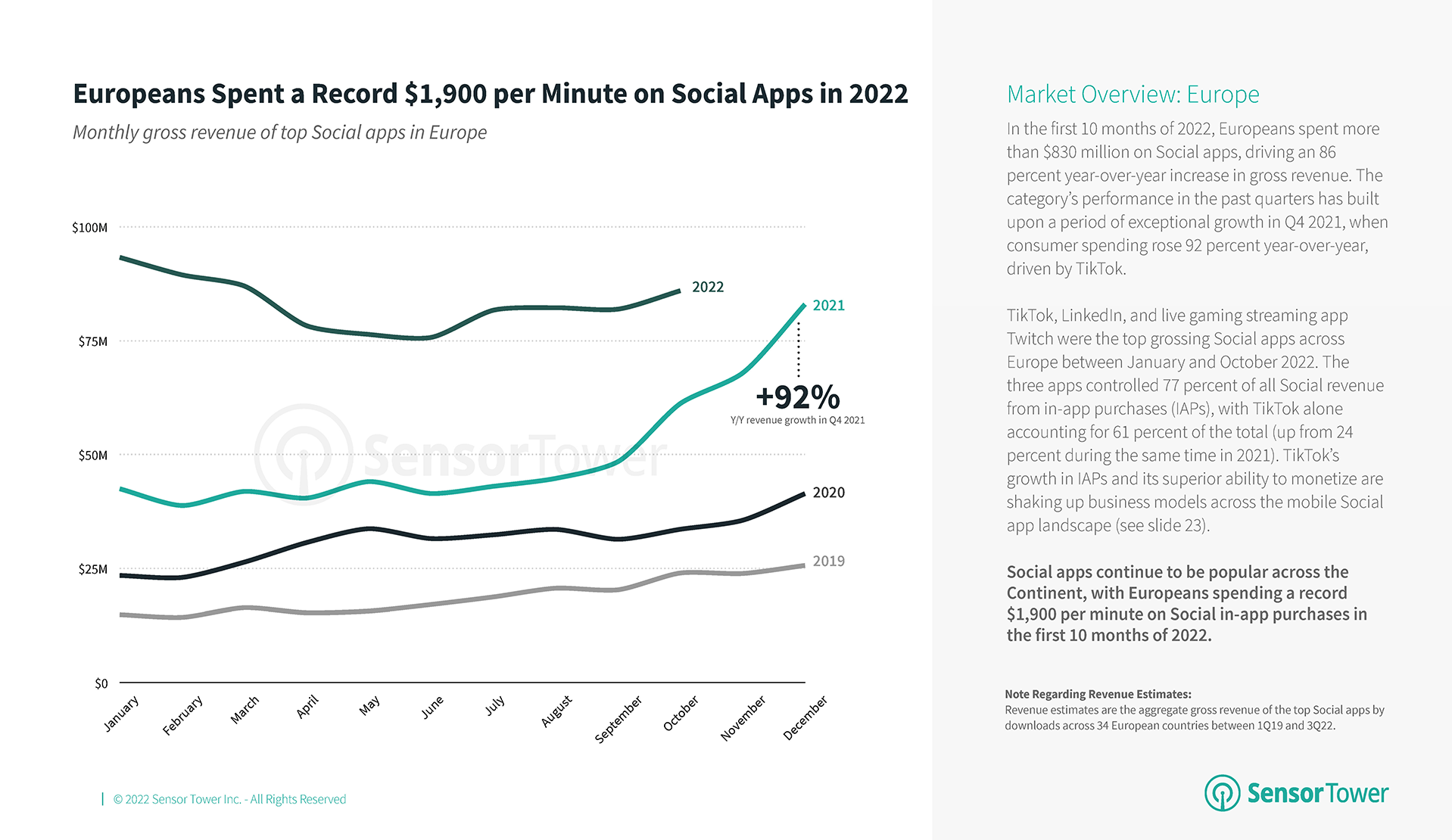

Europeans Spent a Record $1,900 per Minute on Social Apps in 2022

European consumers spent more than $830 million on Social apps in the first 10 months of 2022, driving an 86 percent year-over-year increase in gross revenue. Between January and October 2022, TikTok, LinkedIn, and Twitch were the top grossing Social apps across Europe. The cohort of apps accounted for 77 percent of all Social revenue from in-app purchases.

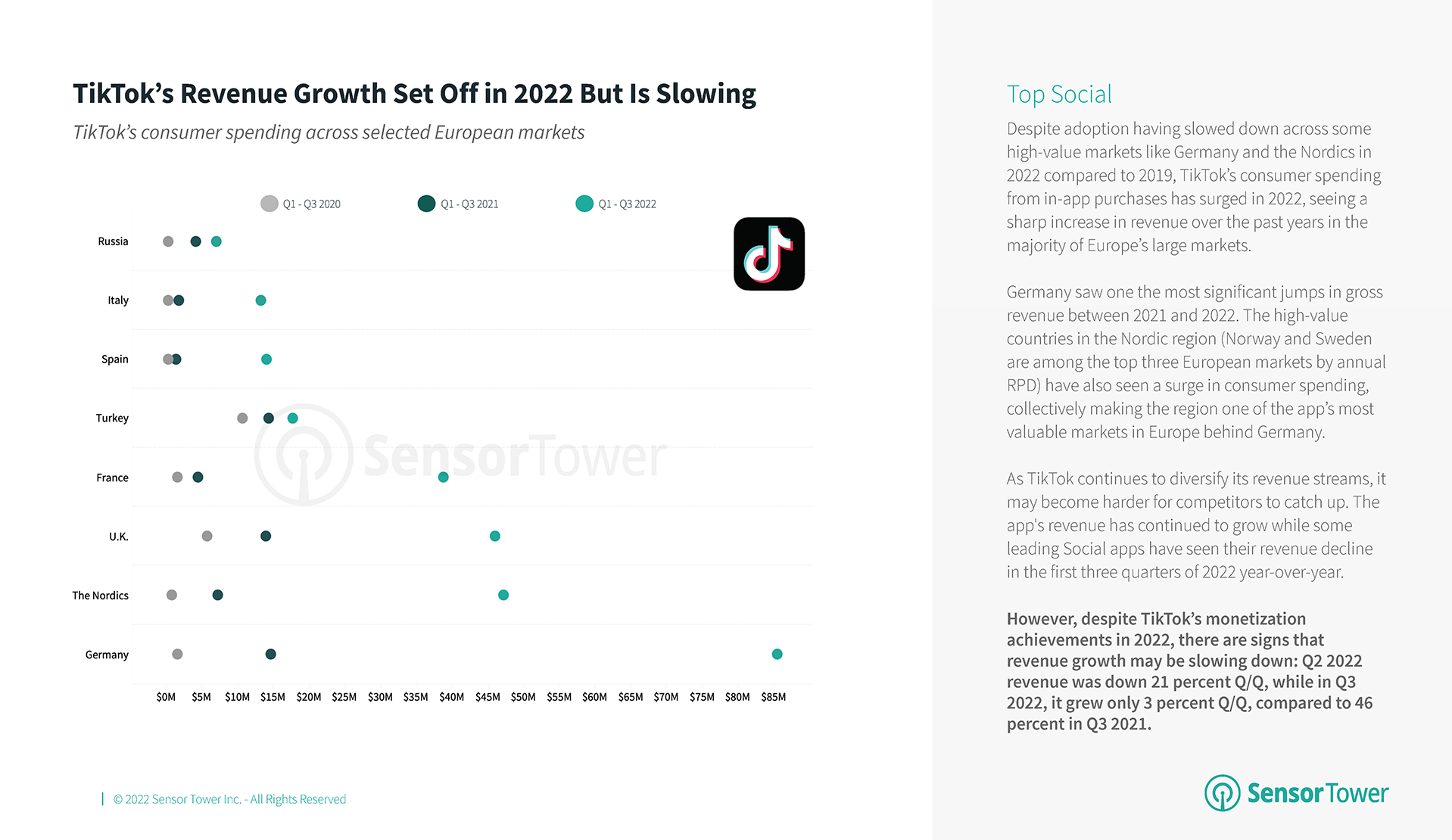

TikTok’s Consumer Spending Surged This Year

TikTok’s revenue soared in 2022; however, there are signs that consumer spending is slowing. In Q3 2022, the social app’s revenue only grew 3 percent quarter-over-quarter compared to 46 percent Q/Q in Q3 2021. Despite this, it saw one of the most significant jumps in gross revenue between 2021 and 2022 in the German market, and as TikTok continues to diversify its revenue streams, other competitors may find it difficult to catch up.

In addition to TikTok’s continued success, social media giants are now also competing with newcomers such as BeReal. The success of the app’s dual-camera feature and a time-sensitive notification strategy has propelled other platforms to roll out similar features, indicating that this could be a key trend going into 2023 and beyond.

For more insights into the Social app category in Europe, download the full State of Social Apps report below.