We’ve acquired Video Game Insights (VGI)!

Sensor Tower · Sam Aune · March 2025

State of Mobile Gaming 2025: The definitive industry report

State of Mobile Gaming 2025 explores the biggest shifts in the industry: from the monetization models driving growth to the ad strategies winning over players. See how casual games surged in the West, developers doubled down on live services, and platforms like TikTok and Applovin reshaped mobile game advertising.

As the industry’s gold standard, our State of Mobile Gaming report breaks down how the market evolved in 2024, who the winners were, and what opportunities lay ahead for 2025.

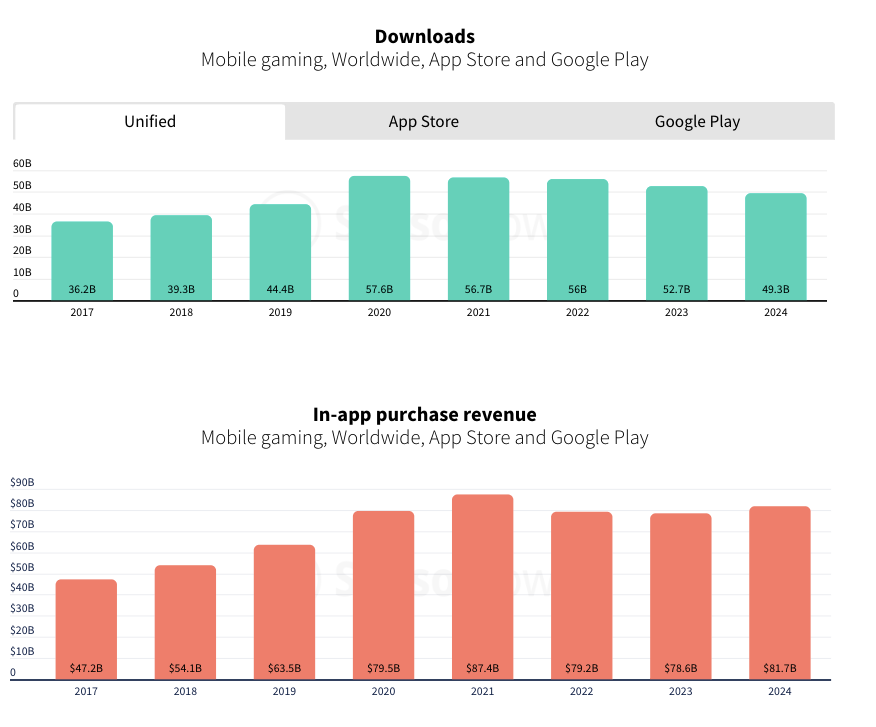

With the first quarter of the year drawing to a close, we can state at least one thing for certain - mobile gaming is back on track. Though downloads plateaued through 2024, in-app purchase revenue, time spend, and sessions are all on the rise.

The illustrated and interactive, 50+ page report includes:

✅ A data-driven overview on the most important trends of the industry, including downloads, revenue, and engagement.

✅ A detailed exploration of the winners of 2024 and what drove their success

✅ A deep dive into mobile game marketing, including which ad networks saw the most impression share growth in 2024 and the three creative trends of 2024 you need to know

But don’t take our word for it. Here are some of the key highlights:

Casual vs. Hybridcasual: The Surprising Shifts in Mobile Gaming

📈 Mobile gaming in-app purchase revenue grew 4% year over year in 2024, with time spent up 8% and number of sessions up 12%. This growth occurred in spite of the continuing download decline, with developers refocusing on live ops in existing titles.

💸 Players spent $82 billion in mobile game in-app purchases in 2024, growth was mostly seen on iOS, with Android in-app purchase revenue falling flat year over year. Casual games saw the most absolute growth, though Hybridcasual games soared to a 37% increase in in-app purchase revenue year over year.

📲 Mobile games were downloaded 49 billion times, a 7% decline from 2023. Interestingly, this decline was mostly felt by casual games: the same category that saw the most in-app purchase revenue growth.

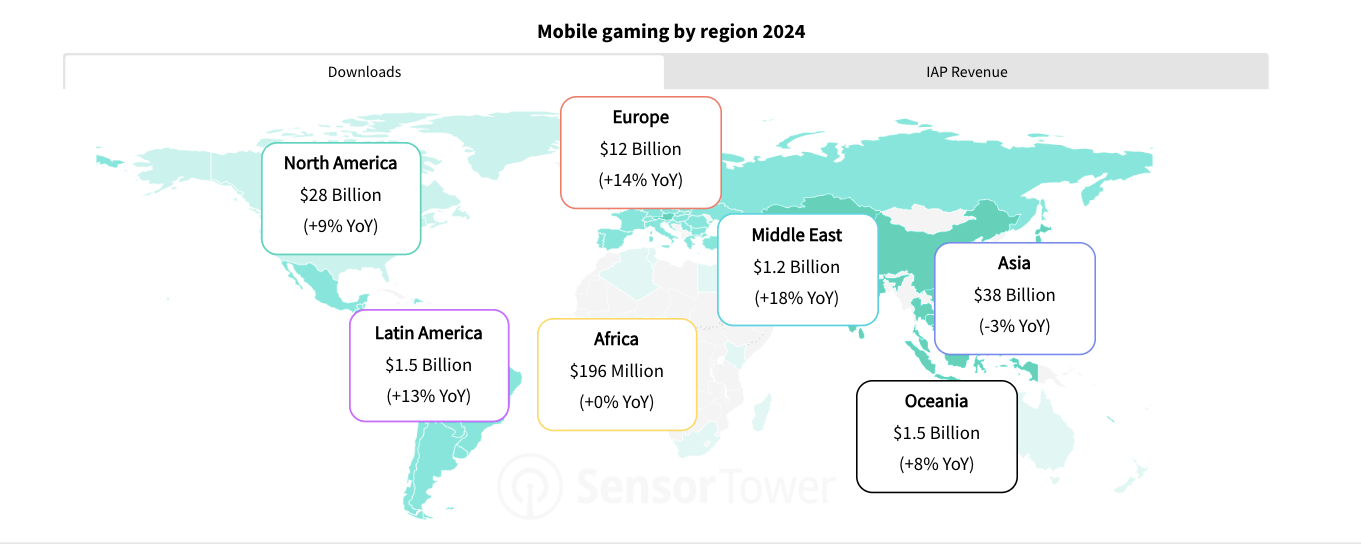

Where Gamers Are Spending: Regional Trends & Market Growth

🌎 The most in-app purchase growth was seen in Western markets, with North America seeing a 9% increase and Europe seeing a 14% increase. However, secondary markets also saw significant growth, with Latin America up 13%, the Middle East up 18%, and Oceania up 8%. The only major region to see a decline was Asia, which declined 3% year over year. However, some of this is attributable to the fact that this analysis is in US dollars, which has exhibited notable strength vs several Asian currencies recently.

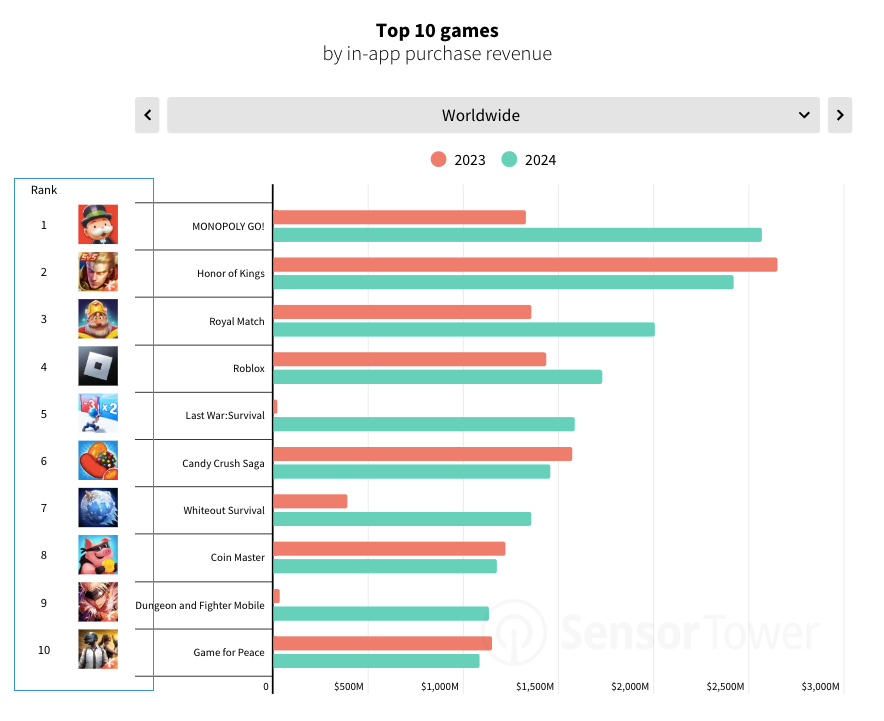

The Biggest Winners of 2024: Who Dominated the Charts?

🏆 MONOPOLY GO! was the big winner of 2024, bringing in the most in-app purchase revenue worldwide. Scopely’s breakout hit, which launched in 2023, combines the beloved MONOPOLY intellectual property with proven coin looter gameplay. Honor of Kings came in at #2, remaining the largest mid-core title in the world.

🎮 Honorable mentions for 2024 include Roblox, Last War: Survival, and Whiteout Survival. Last War: Survival and Whiteout Survival are 4x strategy games launched in 2023 that streamlines the gameplay of 4x strategy games while retaining the genre’s strong progression and monetization. Perhaps most notably, these games are very ad-creative-friendly with a universal style that supported success in both the East and West. Developers would do well to take these two examples of success to heart: Last War: Survival saw the most year over year in-app purchase revenue growth of any mobile game in 2024.

Want more insights? Get your game-face ready. Click here to download the full report.